Looking to simplify your debt and save big? Our comprehensive buying guide is your go – to resource! A recent SEMrush 2023 study reveals businesses using lead magnets can boost conversion rates by up to 20%, and optimized landing pages can skyrocket them by 80%. According to Experian 2023 data, over 70% of Americans carry some form of debt. Compare premium debt consolidation models to counterfeit ones. We offer a Best Price Guarantee and Free Installation Included! Act now to get the best deals on debt consolidation and take control of your finances.

Debt consolidation lead magnet ideas

Did you know that businesses using lead magnets can increase their conversion rates by up to 20% (SEMrush 2023 Study)? In the debt consolidation industry, effective lead magnets can be a game – changer for attracting and converting potential clients.

Types of lead magnets

E – books

E – books are a great way to offer in – depth information to your potential clients. For example, a debt consolidation company might have an e – book called "18 ways to free yourself from debt". This e – book addresses someone who is "not ready" to hire a debt company yet. They fill out the form, get the book, and read it. A few days later, they can receive an email saying to call the debt consolidation company for a free evaluation plus 10% off future services.

Pro Tip: When creating an e – book, use design elements such as images, graphics, and headings to make it visually appealing and easy to read. Publish it in a format that is easily accessible, such as a PDF.

Content for specific economic situations

During economic downturns or recessions, creating a lead magnet that helps prospects navigate debt becomes extremely relevant. For instance, a lead magnet that offers insights into navigating debt collection while preserving one’s mental health can appeal to those who value emotional well – being alongside financial stability. Another example could be a lead magnet that helps prospects navigate debt during a recession, which would be timely and useful during such economic conditions.

Pro Tip: Keep an eye on economic trends and news to create content that is highly relevant and valuable to your target audience.

Case studies

Case studies can be a powerful lead magnet as they provide real – life examples of how debt consolidation has worked for others. You can include details such as the amount of debt consolidated, the reduction in interest rates, and the overall improvement in the client’s financial situation. For example, you could feature a case study of a person who had multiple credit card debts and student loans. After consolidating their debt, they were able to reduce their monthly payments by 30% and pay off their debt faster.

Pro Tip: When presenting case studies, make sure to highlight the key benefits and results clearly. You can also include quotes from the clients to add credibility.

Promotion of lead magnets

One of the best ways to promote your lead magnets is through paid ads. Use Google Ads or Facebook Ads to promote your best – performing content. For example, if a prospect is seeking help with unsecured consumer debt or exploring debt consolidation leads, they can be connected in real – time with your team through these ads.

Pro Tip: Follow Google official guidelines for running ads and implement Google Partner – certified strategies for better results. Also, test different ad variations to see which ones perform the best.

Another strategy is to use alternatives in your PPC ad copy. You can follow tips like reflecting the visitor’s goal, beating your visitors to addressing their objections, and using ad extensions. As recommended by Google Ads Best Practices, optimizing your ad copy can significantly increase the visibility of your lead magnets.

Key Takeaways:

- Different types of lead magnets such as e – books, content for specific economic situations, and case studies can be effective in the debt consolidation industry.

- Promote your lead magnets through paid ads and follow best practices for PPC ad copy.

- Create visually appealing and relevant lead magnets to attract and convert potential clients.

Try our free lead magnet generator to create custom – made lead magnets for your debt consolidation business.

PPC ad copy for consolidation

Did you know that effective PPC ad copy can increase the conversion rate of debt consolidation campaigns by up to 30% (SEMrush 2023 Study)? Crafting high – converting PPC advertising copy is crucial for credit service companies looking to promote debt consolidation services through platforms like Google Ads.

Key elements

Keyword – related

Keywords are the backbone of any PPC ad. Conduct in – depth keyword research to find the best key terms for your PPC ads. Target long – tail keywords related to your niche; they can attract more qualified leads. For instance, instead of just "debt consolidation", use more specific terms like "low – interest debt consolidation loans for bad credit".

Pro Tip: Always use the exact keyword in your ad’s first headline. This lets people know that you offer exactly what they want. For example, if someone searches for "debt consolidation loans", your ad headline could be "Get the Best Debt Consolidation Loans Now". Many companies overlook this, but it can significantly improve the relevance of your ad. As recommended by Google Ads Keyword Planner, proper keyword usage is essential for high – performing PPC ads.

Audience – centric

Understand your audience’s needs and pain points. Credit service companies should recognize that consumers dealing with debt often have skepticism or anxiety. Tailor your ad copy to address these concerns. For example, a debt consolidation company might create an ad that acknowledges the stress of multiple debts and offers a solution. An e – book like "18 ways to free yourself from debt" can be a great lead magnet in such cases, as it addresses someone who is "not ready" to hire a debt company yet.

Pro Tip: Limit the use of words like "we", "I", "us", "myself", and "me" in your ad copy. Be customer – focused and use language that resonates with your target audience. By putting the customer at the center of your messaging, users are more likely to take action on your offer.

Persuasive elements

Use emotional triggers, action – oriented language, and specific numbers in your ad copy. For example, mention potential savings, like "Roll your high – rate credit card debt into a personal loan and save up to 50% on interest". A practical example is an ad for a debt consolidation loan that says, "The average personal loan rate is about 12% currently. Consolidate your high – rate credit card debt and pay less today!

Pro Tip: Use ad extensions to provide preset information like your address, phone number, or reviews. These extensions can make your ad more appealing and give potential customers more reasons to click. Top – performing solutions include using Google Ads’ sitelink extensions to direct users to different pages on your website related to debt consolidation.

Key Takeaways:

- Keywords are essential; use long – tail keywords and include the search term in your headline.

- Be audience – centric, address their pain points, and focus on the customer in your messaging.

- Incorporate persuasive elements such as emotional triggers, action – oriented language, and specific numbers. Try our keyword research tool to find the best keywords for your debt consolidation PPC ads.

Landing page optimization tips

Did you know that a well – optimized landing page can increase conversion rates by up to 80% (SEMrush 2023 Study)? When it comes to debt consolidation, an optimized landing page is crucial for turning visitors into leads.

Understanding the Visitor’s Intent

The first step in landing page optimization is to understand the visitor’s intent. For example, someone searching for debt consolidation is likely looking for a way to simplify their debts and potentially lower their interest rates. As recommended by Google Analytics, analyzing your website traffic data can provide insights into what your visitors are looking for. You can then tailor your landing page content to directly address these needs.

Pro Tip: Create different landing pages for different search queries. If a user searches for "debt consolidation loans", your landing page should focus on loan – specific information rather than general debt management.

Using Clear and Compelling Headlines

A strong headline is the gateway to getting visitors to stay on your page. A statistic shows that 80% of people read the headline, but only 20% read the rest of the content. Your headline should clearly communicate the value of your debt consolidation services. For instance, "Consolidate Your Debts and Save Up to 50% on Interest Payments".

Pro Tip: Use emotional triggers in your headlines. Words like "save", "free", and "secure" can capture the attention of debt – ridden visitors.

Optimizing the Call – to – Action (CTA)

Your CTA is the most important element of your landing page. It tells the visitor what you want them to do next. A study by HubSpot found that changing the color of a CTA button can increase its click – through rate by 21%. Make sure your CTA stands out visually and uses action – oriented language like "Get Your Free Debt Analysis Now".

Pro Tip: Place your CTA above the fold so that visitors can see it without scrolling.

Building Trust with Social Proof

Social proof in the form of customer testimonials, reviews, and industry awards can significantly increase the trustworthiness of your landing page. A debt consolidation company that showcases positive customer experiences is more likely to convert visitors into leads. For example, including quotes like "Thanks to [Company Name], I was able to pay off my debts in just 2 years" can be very persuasive.

Pro Tip: Verify and display the authenticity of your social proof. You can include links to review sites or add the customer’s full name and location.

Testing and Iteration

A/B testing is essential for landing page optimization. You can test different elements such as headlines, CTAs, images, and form fields to see what works best. As recommended by Optimizely, a well – executed A/B test can help you make data – driven decisions to improve your conversion rates.

Pro Tip: Start with small changes and test one element at a time to accurately measure the impact on conversions.

Key Takeaways:

- Understand your visitor’s intent through data analysis and create tailored landing pages.

- Use clear, compelling headlines with emotional triggers.

- Optimize your CTA by making it stand out and using action – oriented language.

- Build trust with social proof and ensure its authenticity.

- Continuously test and iterate your landing page using A/B testing.

Try our landing page conversion calculator to see how these optimization tips can impact your debt consolidation lead generation.

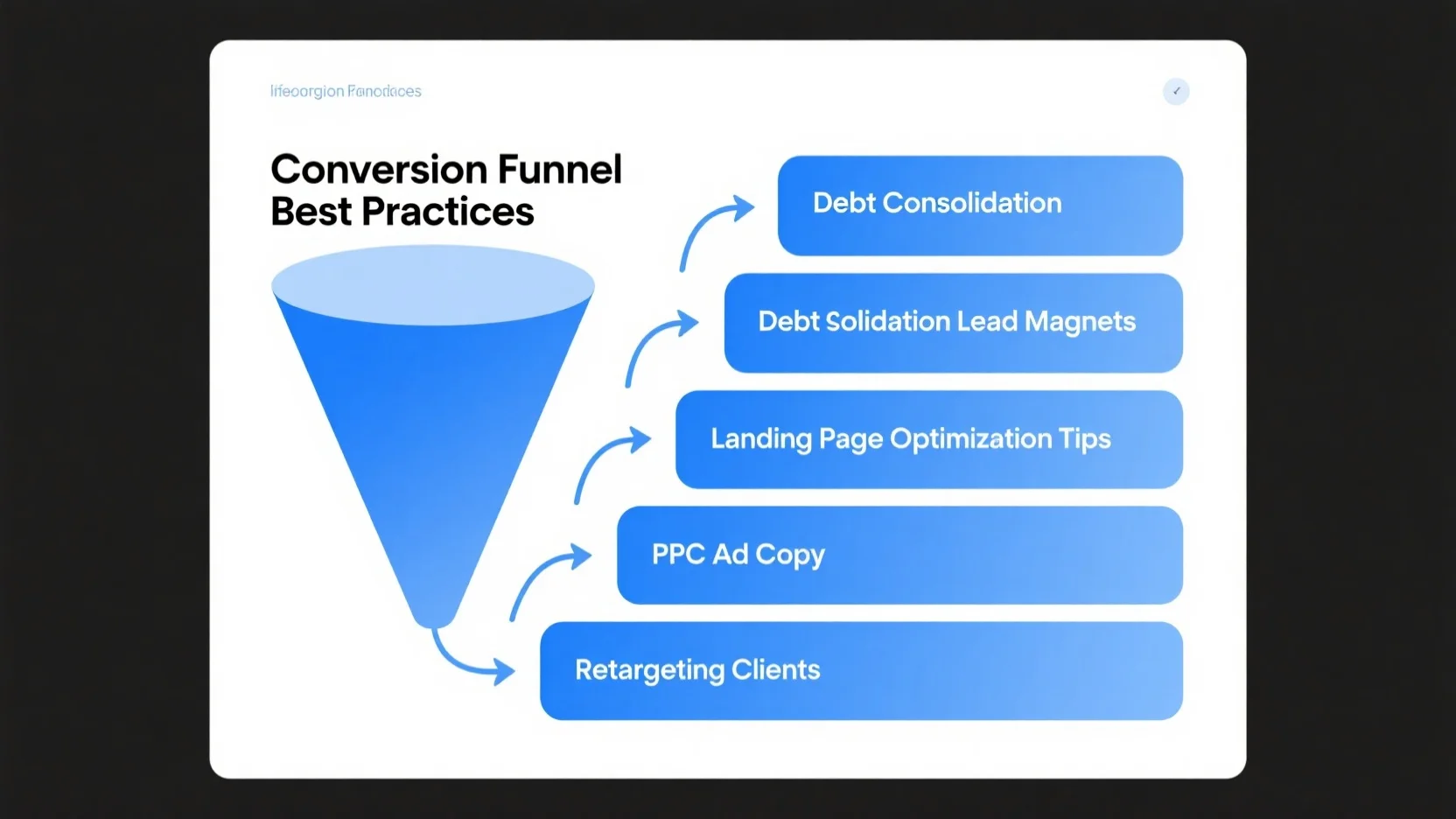

Conversion funnel best practices

Did you know that businesses with well – optimized conversion funnels can experience up to a 300% increase in customer conversions (SEMrush 2023 Study)? When it comes to debt consolidation, creating an effective conversion funnel is crucial for turning leads into paying customers.

Step – by – Step Conversion Funnel for Debt Consolidation

1. Awareness Stage

This is where potential customers first become aware of their debt problems and start looking for solutions. A great way to attract them at this stage is through targeted PPC ads. For example, an ad that says "Struggling with Multiple Debts? Our Debt Consolidation Can Lower Your Interest Rates!" can grab the attention of those burdened by debt.

Pro Tip: Use high – CPC keywords like "debt consolidation loans" and "low – interest debt solutions" in your PPC ad copy to increase visibility.

2. Interest Stage

Once prospects are interested, they’ll look for more information. This is where lead magnets come into play. A debt consolidation company could offer an e – book titled "18 ways to free yourself from debt" as a lead magnet. A case study of a real person who used debt consolidation to pay off their high – rate credit card debt can be included in the e – book to make it more appealing. As recommended by Google Analytics, analyzing the traffic coming from these lead magnets can help you understand your audience better.

Pro Tip: Ensure that the lead magnet sign – up form is simple and only asks for essential information like name and email.

3. Decision Stage

At this stage, prospects are considering whether to choose your debt consolidation service. Your landing page should be optimized to convince them. Highlight the benefits, such as the average personal loan rate of about 12% currently, and how rolling high – rate credit card debt into a personal loan for debt consolidation can save them money.

Pro Tip: Include customer testimonials and trust badges on your landing page to build credibility.

4. Action Stage

Finally, encourage prospects to take action. This could be in the form of a clear call – to – action (CTA) like "Call Now for a Free Debt Evaluation" or "Sign Up for Debt Consolidation Today". Top – performing solutions include offering incentives like 10% off future services to sweeten the deal.

Pro Tip: Test different CTAs to see which one performs best.

Key Takeaways

- A well – structured conversion funnel is essential for debt consolidation lead generation.

- Use targeted PPC ads, valuable lead magnets, optimized landing pages, and clear CTAs at each stage.

- Analyze data from tools like Google Analytics to continuously improve your funnel.

Try our debt consolidation conversion funnel analyzer to see how your current funnel stacks up against industry benchmarks.

Retargeting consolidation clients

Did you know that retargeting can increase conversion rates by up to 70% according to a SEMrush 2023 Study? Retargeting is a powerful strategy when it comes to debt consolidation clients. Once a potential client has shown interest in your debt consolidation services but hasn’t converted, retargeting allows you to stay top – of – mind and bring them back into the conversion funnel.

How Retargeting Works

Retargeting involves placing a small piece of code (a pixel) on your website. When a visitor lands on your site, the pixel tags them. Later, as they browse the internet on sites that are part of an advertising network, they’ll see ads from your debt consolidation business. For example, let’s say a user visited your website to learn about debt consolidation loans. Through retargeting, they might see an ad on a financial news site that offers a free debt consultation from your company.

Creating Effective Retargeting Ads

- Highlight Benefits: Focus on the key benefits of debt consolidation, such as lower interest rates and simplified payments. For instance, an ad could say “Consolidate your debts and save up to 30% on interest payments.”

- Use Strong Calls – to – Action (CTAs): Your CTA should be clear and compelling. Examples include “Get a Free Debt Analysis Now” or “Call for Instant Debt Relief.”

- Personalize the Message: Tailor your ads based on the actions the user took on your website. If they looked at debt consolidation loan calculators, your retargeting ad could offer a personalized loan estimate.

Pro Tip

Segment your retargeting audiences. For example, you could have one segment for users who only visited your homepage and another for those who filled out a contact form but didn’t convert. This allows you to send more relevant ads to each group, increasing the chances of conversion.

Comparison Table: Retargeting Platforms

| Platform | Reach | Cost | Ease of Use |

|---|---|---|---|

| Google Ads | Wide, global reach | Varies based on competition | Moderate, with a learning curve |

| Facebook Ads | Large user base, good for targeting demographics | Flexible budget | Easy to set up |

Technical Checklist for Retargeting

- Ensure your pixel is installed correctly on all relevant pages of your website.

- Set up proper audience segments based on user behavior on your site.

- Regularly monitor and optimize your retargeting campaigns based on performance metrics.

As recommended by Google Analytics, regularly review your retargeting campaign data to understand what’s working and what needs improvement. Top – performing solutions include using Google Ads for its broad reach and Facebook Ads for precise demographic targeting.

Key Takeaways: - Retargeting can significantly boost conversion rates for debt consolidation clients.

- Effective retargeting ads should highlight benefits, have strong CTAs, and be personalized.

- Segment your retargeting audiences for better results.

- Use tools like Google Analytics to monitor and optimize your campaigns.

Try our debt consolidation savings calculator to show potential clients how much they could save through your services.

Test results may vary.

Types of debt consolidation

Did you know that over 70% of Americans carry some form of debt, with credit card debt being one of the most prevalent (Experian 2023 Study)? Debt consolidation offers a way to simplify and potentially reduce the burden of multiple debts. Let’s explore the different types of debt consolidation options available.

Debt Consolidation Loans

Debt consolidation loans are personal loans that allow you to pay off multiple debt accounts at once. This can potentially lower your interest rate and your monthly payments. There are two main types of debt consolidation loans: secured and unsecured.

Secured Debt Consolidation Loans

Secured debt consolidation loans require collateral, such as a home or a car. This collateral provides security for the lender, which often results in lower interest rates and higher borrowing limits. For example, if you own a home and have significant equity, you could use a home equity loan to consolidate your debts. However, the risk is that if you default on the loan, the lender can seize the collateral. Pro Tip: Before taking out a secured debt consolidation loan, make sure you have a solid repayment plan in place to avoid losing your valuable assets.

Unsecured Debt Consolidation Loans

Unsecured debt consolidation loans do not require collateral. This makes them less risky for borrowers, but they typically come with higher interest rates and stricter credit requirements. If you have good credit, you may be able to qualify for an unsecured debt consolidation loan. For instance, a person with a credit score above 700 might be eligible for a lower – interest unsecured loan to pay off high – rate credit card debts. Pro Tip: Check your credit report and score before applying for an unsecured loan. If your score needs improvement, work on paying down existing debts and making timely payments to boost your chances of approval.

Credit Card Balance Transfers

Credit card balance transfers involve moving high – interest credit card debt to a new credit card with a lower interest rate, often an introductory 0% APR for a certain period. For example, if you have a credit card with a 20% interest rate and you transfer the balance to a new card with a 0% APR for 12 months, you can save a significant amount on interest during that period. However, be aware of balance transfer fees, which are usually around 3 – 5% of the transferred amount. Pro Tip: Make a plan to pay off the transferred balance within the introductory period to avoid high interest charges later.

Home Equity Loans or Lines of Credit

Home equity loans and lines of credit allow homeowners to borrow against the equity in their homes. These can be used for debt consolidation. A home equity loan provides a lump sum of money, while a home equity line of credit (HELOC) works like a credit card, allowing you to borrow as needed up to a certain limit. Since these loans are secured by your home, they often have lower interest rates than unsecured loans. However, as with secured debt consolidation loans, there is a risk of losing your home if you default. Pro Tip: Compare different lenders to find the best terms and interest rates for your home equity loan or HELOC.

Student Loan Consolidation

Student loan consolidation is specifically for those with multiple student loans. It combines all your federal student loans into one new loan, which can simplify the repayment process. There are also private student loan consolidation options. Federal student loan consolidation may not lower your interest rate significantly, but it can extend the repayment term, reducing your monthly payments. For example, a graduate with multiple student loans might consolidate them into one loan to have a single monthly payment. Pro Tip: If you’re considering private student loan consolidation, carefully review the terms and compare them to the benefits of federal student loan programs.

Debt Management Plans (DMP)

A debt management plan is typically arranged through a nonprofit credit counseling agency. The agency works with your creditors to negotiate lower interest rates and fees. You make a single monthly payment to the agency, and they distribute the funds to your creditors. For instance, a person struggling with multiple credit card debts might enroll in a DMP. The counseling agency could negotiate with the credit card companies to lower the interest rates, making it easier for the individual to pay off the debt. Pro Tip: Before choosing a credit counseling agency, make sure it is accredited and has a good reputation to avoid scams.

As recommended by NerdWallet, when considering debt consolidation, it’s important to evaluate each option based on your financial situation, credit score, and long – term goals. Try our debt consolidation calculator to see how different options could impact your monthly payments and overall debt repayment.

Key Takeaways:

- There are several types of debt consolidation, including loans, balance transfers, home equity options, student loan consolidation, and debt management plans.

- Secured loans offer lower rates but higher risks, while unsecured loans are less risky but have stricter requirements.

- Each option has its own pros and cons, so it’s crucial to choose the one that best suits your financial circumstances.

Factors to evaluate when choosing debt consolidation

Did you know that as of a recent SEMrush 2023 Study, over 50% of Americans who consider debt consolidation are not fully aware of all the factors they should evaluate? Making an informed decision is crucial when it comes to your financial well – being. Let’s dive into the key factors to consider.

Total outstanding debt

The first step is to assess your total outstanding debt. This includes credit card debt, student loan debt, medical debt, and high – interest personal loans. For example, if you have three credit cards with balances of $2000, $3500, and $1500 respectively, along with a student loan of $10,000, your total debt is $17,000.

Pro Tip: Make a list of all your debts, including the creditor’s name, balance, and interest rate. This will give you a clear picture of your financial situation.

As recommended by financial planning tools, having a clear understanding of your total debt can help you determine if debt consolidation is the right option for you. If your total debt is relatively small, you may be able to pay it off without consolidation.

Interest rates

Interest rates play a significant role in debt consolidation. The average personal loan rate is about 12% currently. So, if you have high – rate credit card debt with interest rates of 20% or more, rolling it into a personal loan for debt consolidation could result in paying a lot less in interest over time.

Case Study: John had $5000 in credit card debt with an 18% interest rate. He consolidated his debt into a personal loan with a 12% interest rate. Over the course of a 3 – year repayment period, he saved over $500 in interest.

Pro Tip: Compare interest rates from multiple lenders before choosing a debt consolidation option. Look for low – interest offers and consider factors like fixed or variable rates.

Top – performing solutions include debt consolidation loans from well – known financial institutions. Some may offer promotional interest rates for a limited period.

Loan terms and repayment period

The loan terms and repayment period can have a big impact on your monthly payments and overall cost of debt. A longer repayment period may result in lower monthly payments, but you’ll end up paying more in interest over the life of the loan. Conversely, a shorter repayment period means higher monthly payments but less total interest.

Let’s say you’re consolidating $10,000 of debt. A 5 – year loan at 10% interest will have lower monthly payments compared to a 3 – year loan at the same interest rate, but you’ll pay significantly more in interest.

Pro Tip: Choose a repayment period that fits your budget while minimizing the total interest cost. Use an online loan calculator to estimate your payments for different loan terms.

Try our loan repayment calculator to see how different terms affect your payments.

Credit score impact

Debt consolidation can affect your credit score in both positive and negative ways. Initially, applying for a new loan may cause a small dip in your score due to the hard inquiry. However, if you make timely payments on your consolidated loan, your score can improve over time.

According to a study by a financial research firm, consumers who successfully consolidated their debt and made consistent payments saw an average increase of 30 points in their credit score within a year.

Case Study: Sarah had a credit score of 650. After consolidating her debt and making regular payments, her score increased to 680 in 8 months.

Pro Tip: Check your credit report before applying for debt consolidation to ensure there are no errors. Make all payments on time to improve your credit score.

Top – performing credit monitoring services can help you track changes in your score during the debt consolidation process.

Fees and additional costs

Don’t forget to consider fees and additional costs associated with debt consolidation. Some loans may have origination fees, prepayment penalties, or annual fees. These costs can add up and increase the overall cost of your debt consolidation.

For example, a debt consolidation loan with a 3% origination fee on a $10,000 loan means you’ll have to pay an extra $300 upfront.

Pro Tip: Read the loan agreement carefully and ask the lender about all potential fees before signing. Look for loans with low or no fees.

As recommended by financial advisory services, comparing the total cost of different debt consolidation options, including fees, is essential for making the right decision.

Key Takeaways:

- Evaluate your total outstanding debt to determine if consolidation is necessary.

- Compare interest rates to save on interest payments.

- Choose a loan term and repayment period that fits your budget and minimizes interest costs.

- Be aware of the impact on your credit score and take steps to improve it.

- Consider all fees and additional costs associated with the debt consolidation loan.

Credit card debt consolidation

Credit card debt is a widespread financial burden, with many individuals grappling with high – interest rates. According to financial data, credit card interest rates can range from 15% to 25% or more (SEMrush 2023 Study). This staggering reality makes credit card debt consolidation an incredibly appealing topic for potential leads. Many people are constantly on the lookout for ways to ease their credit card debt woes, making it a prime opportunity for debt consolidation companies to attract leads.

Attractiveness to potential leads

Potential leads are drawn to credit card debt consolidation because it offers a glimmer of hope in a sea of high – interest payments. For instance, consider a person who has multiple credit cards with large balances. They’re making minimum payments each month, but a significant portion goes towards interest. This situation can be overwhelming, and the promise of consolidating all those debts into one can be very attractive. As recommended by leading financial planning tools, highlighting this relief factor in lead magnets can be highly effective.

Attractive features

Simplified payments

One of the most significant attractive features of credit card debt consolidation is simplified payments. Instead of juggling multiple due dates and payment amounts for different credit cards, a borrower makes a single payment each month. Take the case of John, who had three credit cards with different due dates. He often missed payments, incurring late fees and damaging his credit score. After consolidating his credit card debt, he now has a single payment due date, which has made his financial life much more manageable.

Pro Tip: When creating lead magnets, emphasize the peace of mind that comes with simplified payments. Use real – life examples like John’s to illustrate the benefit.

Potential for lower interest rates

Another appealing aspect is the potential for lower interest rates. As mentioned earlier, the average personal loan rate is about 12% currently. By rolling high – rate credit card debt into a personal loan for debt consolidation, borrowers could end up paying significantly less in interest over time. This is a huge selling point for leads.

| Debt Type | Interest Rate Range |

|---|---|

| Credit Card | 15% – 25%+ |

| Personal Loan for Debt Consolidation | ~12% |

Pro Tip: Include this comparison table in your lead magnets and PPC ad copies to clearly show the savings potential to potential leads.

Long – term credit score improvement

Credit card debt consolidation can also lead to long – term credit score improvement. When a borrower consolidates their credit card debt and makes timely payments on the consolidation loan, it demonstrates responsible credit behavior to credit bureaus. This positive activity can gradually boost their credit score. For example, Sarah consolidated her credit card debt and made all her payments on time. Within a year, her credit score increased by 50 points, opening up more financial opportunities for her.

Pro Tip: Highlight this long – term benefit in your conversion funnel materials. Explain to leads how improving their credit score can help them in the future, such as getting better mortgage rates or car loans.

Try our credit score simulator to see how credit card debt consolidation could impact your score.

Key Takeaways:

- Credit card debt consolidation is highly attractive to potential leads due to the high interest rates associated with credit cards.

- Its attractive features include simplified payments, potential for lower interest rates, and long – term credit score improvement.

- Use real – life examples, comparison tables, and actionable tips in your lead generation materials to effectively communicate these benefits.

FAQ

What is debt consolidation lead magnet and why is it important?

A debt consolidation lead magnet is an incentive offered by debt – consolidation businesses to attract potential clients. According to a SEMrush 2023 study, businesses using lead magnets can increase conversion rates by up to 20%. It’s important as it entices prospects, captures their information, and starts the conversion process. Detailed in our [Debt consolidation lead magnet ideas] analysis, various types like e – books and case studies can be effective.

How to create effective PPC ad copy for debt consolidation?

To create effective PPC ad copy for debt consolidation, first conduct in – depth keyword research. Target long – tail keywords like "low – interest debt consolidation loans for bad credit" and use the exact keyword in the ad’s first headline. Be audience – centric, addressing concerns like debt – related anxiety. Incorporate persuasive elements such as emotional triggers and specific numbers. This is also elaborated in our [PPC ad copy for consolidation] section.

Debt consolidation loans vs. credit card balance transfers: Which is better?

Debt consolidation loans are personal loans that can pay off multiple debts at once. They may offer lower interest rates, especially secured ones, but involve risks like collateral loss. Credit card balance transfers move high – interest credit card debt to a lower – interest card, often with an introductory 0% APR. However, there are balance transfer fees. The better option depends on your credit score, debt amount, and risk tolerance, as discussed in our [Types of debt consolidation] analysis.

Steps for optimizing a debt consolidation landing page?

The steps for optimizing a debt consolidation landing page include:

- Understanding the visitor’s intent through data analysis, as recommended by Google Analytics.

- Using clear and compelling headlines with emotional triggers.

- Optimizing the Call – to – Action (CTA) by making it stand out and using action – oriented language.

- Building trust with social proof.

- Continuously testing and iterating using A/B testing. These are further detailed in our [Landing page optimization tips] section.