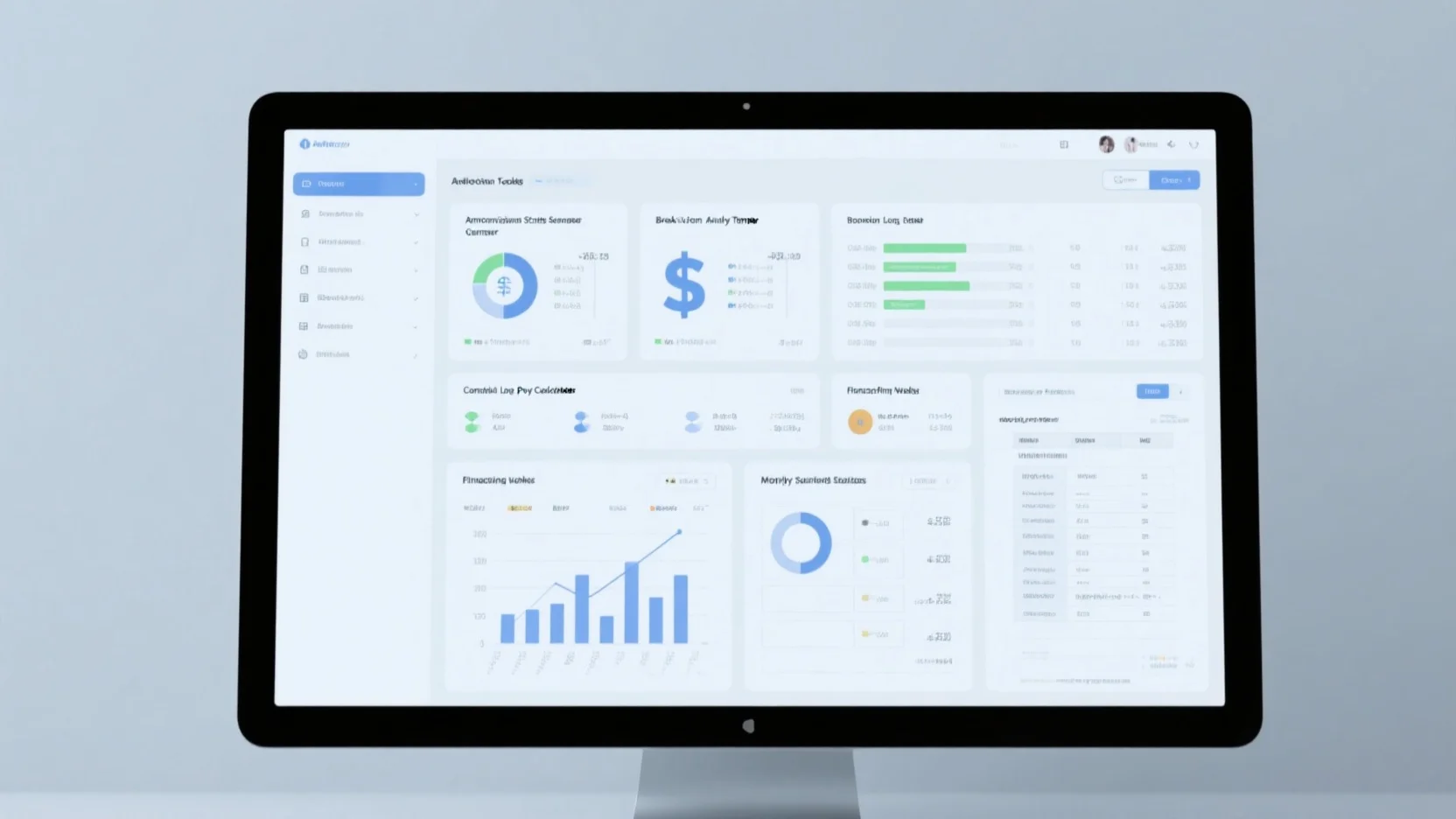

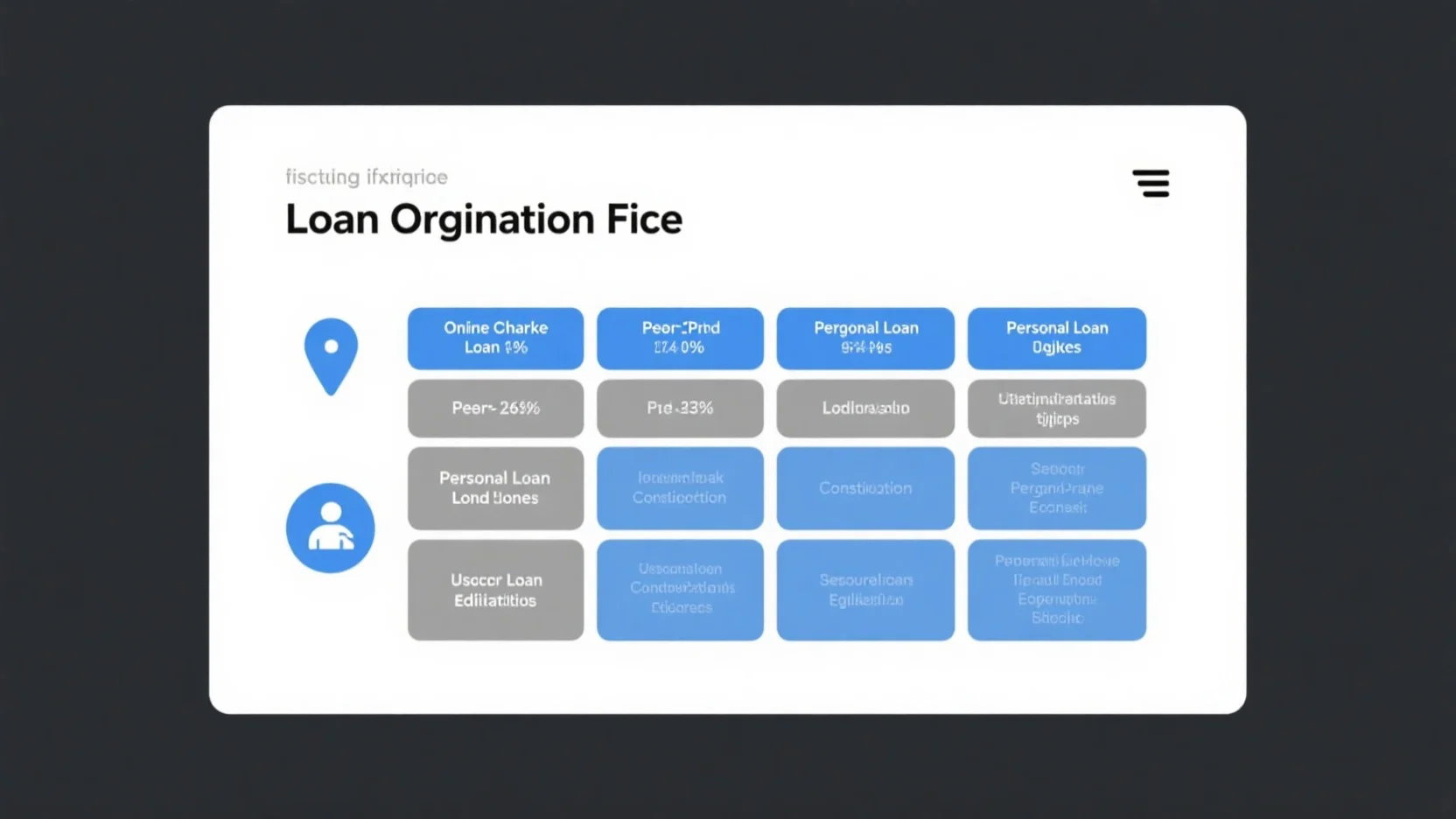

Comprehensive Guide to Consolidation Loan Payoff Calculators and Related Financial Tools: Features, Industries, and Technical Insights

In today’s debt – ridden landscape, with over 70% of Americans in some form of debt (SEMrush 2023 Study), financial tools like consolidation loan payoff calculators are a must – have. Our Premium buying guide on these calculators and related tools offers a fresh take. Compare premium models to counterfeits and see how you can